An Absence of Euphoria

The blog is just a broader write up of my tweet series that was quite well received.

One of the achievements of the Modi government has been the masterful control of inflation. While it can be argued that oil prices helped etc, these are more political arguments than substantive ones.

My concern however, is whether we have been too successful in inflation control, to the point where it has sapped joy from every day life. Yes, I am being facile but this is not way off the mark. There is a distinct absence of a "feel good" factor or euphoria from the economy that one witnesses around them. Even the political commentary from pro-BJP quarters seems to be increasingly data driven.

The name of my blog is Ecopolitical, and as such I cannot completely divorce politics from economics, and politics at the end of the day, is perception based. While I need not go into details how perception management allowed Congress to wrest three States from BJP recently, I cannot overstate its importance.

Bringing a sense of joy to the nation, especially in the crucial election season is paramount. An Euphoric man does not care for Rafale or Mallya. He is not bothered about some economic nitty-gritties. He is happy, and does not want to rock that boat. So why is that despite the stellar work done by Narendra Modi on the economic front, we do not sense that euphoria around us? Why are people increasingly having to be reminded of how fast we are growing or how they are better off?! After all a healthy man does not need a doctor to tell him that. He just feels well!

Lets look at the GDP data below:

While Modi has managed to maintain the Real GDP growth rate at 6.68% for FY18, for example, the nominal growth rate has come down from ~20% levels to just about 10% currently. While this has come on the back of a sharp contraction of inflation, it does raise some troubling questions.

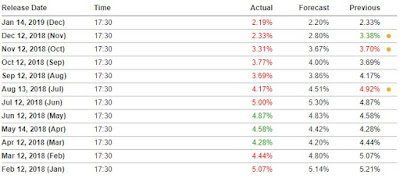

The most obvious of which is, is this control sustainable over the long term? The most recent print of CPI came in at 2.33%, which was below analyst estimates of 2.80%. RBI has tempered its inflation expectation to 2.7-3.2% for the period Oct 2018-March 2019, even as CPI today is at the lowest level in nearly 18 months.

The chart below is the difference between Nominal GDP Cagr and Real GDP Cagr for four year chunks, and it asks the question, how much more Real GDP growth can we squeeze out of inflation control when the gap has narrowed precipitously. If we agree that the FY06 to FY09 period was when UPA 1 was still benefiting from the steps taken by the NDA 1 government, even then the gap was 8%+.

This narrow a gap also renders us vulnerable to a systemic shock. Imagine if inflation rises 2ppt, i.e. from 2.3 to 4.3%. As a number an inflation of 4% is not high at all. But because of the reduced Nominal growth it will have a disproportionate impact on the Real GDP growth numbers. This will have both economic, and political repercussions.

This fall in nominal GDP also has a psychological aspect. A perceives perceives the world in the 'nominal'. He/ she can 'see' their salary going up, but cannot 'see' the purchasing power of their savings going up (which is in effect what a lower inflation does). In fact I would go ahead a step and argue that a lack of nominal growth in fact renders the increased purchasing power of his savings impotent. For, without seeing his top-line grow no one is going to spend savings to make big purchases, so what is the point of this purchasing power?

This beyond a point, excessive control of inflation at the cost of nominal growth becomes counter productive to the economy. A recent example is the fuel price hike. It was useless to explain to someone that if they looked at their inflation basket as a whole they were actually saving more money. The "ticker shock" matters to the psychology, and it is this that drives perceptions.

A person would be happy to have a 15% salary hike and pay higher prices of 10%, versus a salary hike of 7% and inflation of 2%. In both cases, the net 'real' impact is exactly the same, but a 15% salary hike would drive animal spirits in a way that a 7% hike simply wont.

Even when you look at the corporate space (where most of the urban middle class and opinion makers are employed), it has seen a subdued performance. Corporate profits as % of GDP have come down to 3.5% from ~8% in FY08.

This is impacting salary hikes and bonuses. It is again he same thing, the average Joe is not seeing his top-line growing. Without that, he will not make large investments in the economy, such as buying a house for example. This is reflected in the data below taken from a recent news article. The article also says:

"According to National Housing Bank data, property prices in Mumbai and Bengaluru increased annually by just about 7.50% and 5.75% respectively between June 2013 and September 2017. In Delhi, prices actually fell by -0.70% annually during the same period."

Hardly a conducive environment for someone to take long bets on large assets.

I am sure people might counter me by saying that but retail lending is growing at a fast pace. After all as per CIBIL, the aggregate balance of lending products increased 24.5% YY to reach Rs26.1tr in 1Q 2018. But what is the quality of it? By quality I do not mean asset quality (though that is also a concern that time alone will reveal), but the mix of this lending. Is the lending indicating increased confidence by the buyer or not? The answer to me is a resounding NO! The share of consumption lending (credit card, personal loan and consumer durable loan) as a % of total origination account volumes has risen from 65% to nearly 75% in just 2 years. These are not long term commitments made by a euphoric person.

As an aside, anecdotally I am unsure how many of these consumption loans are genuine originations and how many are merely "profit shifting". To give a personal example, I was in a large electronics store to buy an Air Conditioner (AC) and when at the counter, as I was paying I was offered a 6 month (or one year, I do not recall) interest free loan. The loan was extended by a sister company of the electronics shop I was buying the AC at. This I believe is not a true loan, because I was willing to pay the full price then and there. By interest free it means that the full profit that would have accrued to he electronics shop is now being divided between it and its sister company (the lender). This allows the lender to show a higher loan book, but the system profits remain the same.

This lack of nominal growth which has been manifested in various ways (excessive fall in CPI, and also the lack of asset inflation) is at the heart of the absence of Euphoria in the economy. It is merely the outcome of the kind of policies the government has followed so far. Till now, the government carried out a cleaning operation. And people stood by the government despite tremendous personal discomfort because they knew it was being done for a better future. Whether it was Aadhar linkages, or demonetisation, people stood in lines and got it done. However, there is a limited happiness from government releasing numbers of increased income tax filers. Schadenfreude doesn't last beyond a point. Addition of an incremental tax payer may give happiness to an existing tax payer, but that's about it. Honestly, harping on and on about increased tax collections, new taxes being levied, some or the other sop or waiver being given, and new income tax filers is now only serving to irritate people.

Some amount of inflation needs to be infused into the economy so that people can experience the value of their assets growing. For example, when real estate booms, even a person who makes Rs25-30,000/ month feels 'rich' as the value of his residence goes up. People who have been waiting on sidelines of the real estate market saying "aur girega" will suddenly start buying property, propelling sentiments. Remember, their house is generally the biggest asset that a middle class household has, and its value rising has a positive psychological impact on their happiness, even though they will never borrow against the increased value.

To give an analogy, there are two ways of generating profit growth. You can either increase revenues (nominal gdp growth), or cut costs (inflation control), or some judicious combinations of the two. If you excessively focus on just cutting costs while your revenues are falling then the quality of your profits will suffer. At some point you will not be able to cut costs, after which your profits will begin to decline. Also at a larger scale, if everyone focuses on just cutting costs, then one must remember that ones costs are someone else's revenues. The system revenues will eventually stagnate.

To remedy this situation, there are three, almost revenue-neutral things that the government can do immediately:

1) Remove long term capital gains tax on stock market

2) Remove dividend tax on stock market

3) Slash interest rates

Today the investment of the common people in the stock market has dramatically risen. Their traditional savings mechanism of gold having stagnated, people have turned to MFs and SIPs to invest in the stock market. Cutting capital gains tax will improve peoples confidence and should see the stock market rise. A buoyant stock market will be a big boost to the public sentiment. (Right now the BSE 500 index has been flat for over a year)

This is impacting salary hikes and bonuses. It is again he same thing, the average Joe is not seeing his top-line growing. Without that, he will not make large investments in the economy, such as buying a house for example. This is reflected in the data below taken from a recent news article. The article also says:

"According to National Housing Bank data, property prices in Mumbai and Bengaluru increased annually by just about 7.50% and 5.75% respectively between June 2013 and September 2017. In Delhi, prices actually fell by -0.70% annually during the same period."

Hardly a conducive environment for someone to take long bets on large assets.

I am sure people might counter me by saying that but retail lending is growing at a fast pace. After all as per CIBIL, the aggregate balance of lending products increased 24.5% YY to reach Rs26.1tr in 1Q 2018. But what is the quality of it? By quality I do not mean asset quality (though that is also a concern that time alone will reveal), but the mix of this lending. Is the lending indicating increased confidence by the buyer or not? The answer to me is a resounding NO! The share of consumption lending (credit card, personal loan and consumer durable loan) as a % of total origination account volumes has risen from 65% to nearly 75% in just 2 years. These are not long term commitments made by a euphoric person.

As an aside, anecdotally I am unsure how many of these consumption loans are genuine originations and how many are merely "profit shifting". To give a personal example, I was in a large electronics store to buy an Air Conditioner (AC) and when at the counter, as I was paying I was offered a 6 month (or one year, I do not recall) interest free loan. The loan was extended by a sister company of the electronics shop I was buying the AC at. This I believe is not a true loan, because I was willing to pay the full price then and there. By interest free it means that the full profit that would have accrued to he electronics shop is now being divided between it and its sister company (the lender). This allows the lender to show a higher loan book, but the system profits remain the same.

This lack of nominal growth which has been manifested in various ways (excessive fall in CPI, and also the lack of asset inflation) is at the heart of the absence of Euphoria in the economy. It is merely the outcome of the kind of policies the government has followed so far. Till now, the government carried out a cleaning operation. And people stood by the government despite tremendous personal discomfort because they knew it was being done for a better future. Whether it was Aadhar linkages, or demonetisation, people stood in lines and got it done. However, there is a limited happiness from government releasing numbers of increased income tax filers. Schadenfreude doesn't last beyond a point. Addition of an incremental tax payer may give happiness to an existing tax payer, but that's about it. Honestly, harping on and on about increased tax collections, new taxes being levied, some or the other sop or waiver being given, and new income tax filers is now only serving to irritate people.

Some amount of inflation needs to be infused into the economy so that people can experience the value of their assets growing. For example, when real estate booms, even a person who makes Rs25-30,000/ month feels 'rich' as the value of his residence goes up. People who have been waiting on sidelines of the real estate market saying "aur girega" will suddenly start buying property, propelling sentiments. Remember, their house is generally the biggest asset that a middle class household has, and its value rising has a positive psychological impact on their happiness, even though they will never borrow against the increased value.

To give an analogy, there are two ways of generating profit growth. You can either increase revenues (nominal gdp growth), or cut costs (inflation control), or some judicious combinations of the two. If you excessively focus on just cutting costs while your revenues are falling then the quality of your profits will suffer. At some point you will not be able to cut costs, after which your profits will begin to decline. Also at a larger scale, if everyone focuses on just cutting costs, then one must remember that ones costs are someone else's revenues. The system revenues will eventually stagnate.

To remedy this situation, there are three, almost revenue-neutral things that the government can do immediately:

1) Remove long term capital gains tax on stock market

2) Remove dividend tax on stock market

3) Slash interest rates

Today the investment of the common people in the stock market has dramatically risen. Their traditional savings mechanism of gold having stagnated, people have turned to MFs and SIPs to invest in the stock market. Cutting capital gains tax will improve peoples confidence and should see the stock market rise. A buoyant stock market will be a big boost to the public sentiment. (Right now the BSE 500 index has been flat for over a year)

Cutting LTCG is a no-brainer. With the way equities are currently performing it is unlikely to generate a lot of revenue in any case. It might as well be shelved in favour of boosting sentiments.

Finally, RBI needs to cut rates aggressively. India today has the highest Real rates in Asia, BY FAR. This is severely constraining demand. A cut here will bolster the housing market and the housing finance market. Again, it will create a positive feedback loop in the economy.

If elections are to be won, then they will be won not on statistics that people read, but on statistics that people feel. My suggestions may sound like a urban phenomenon but you would be surprised with the far flung areas where a persons "sense of wealth/ richness" is tied to one of these things: property, Stocks, or Gold. No amount of arrest of scamsters, or addition to tax base is going to bring this sense of wealth.

Simple, virtually revenue neutral steps can usher in a sense of richness in the economy. There is no need for unprecedented steps wrt RBI reserves or accounting jugglery. Induce some inflation, particularly asset inflation in the economy by reducing interest rates, and removing shackles on the stock market. Let the people have some fun.

Anirudha V Limaye

Finally, RBI needs to cut rates aggressively. India today has the highest Real rates in Asia, BY FAR. This is severely constraining demand. A cut here will bolster the housing market and the housing finance market. Again, it will create a positive feedback loop in the economy.

If elections are to be won, then they will be won not on statistics that people read, but on statistics that people feel. My suggestions may sound like a urban phenomenon but you would be surprised with the far flung areas where a persons "sense of wealth/ richness" is tied to one of these things: property, Stocks, or Gold. No amount of arrest of scamsters, or addition to tax base is going to bring this sense of wealth.

Simple, virtually revenue neutral steps can usher in a sense of richness in the economy. There is no need for unprecedented steps wrt RBI reserves or accounting jugglery. Induce some inflation, particularly asset inflation in the economy by reducing interest rates, and removing shackles on the stock market. Let the people have some fun.

Anirudha V Limaye

Suoer

ReplyDeleteI would like to thank Raj Mehta who inspired me to put my thoughts in a tweet series, from which this blog evolved.

ReplyDeleteThanks

Delete