July 2019 Inflation, the doves should soar

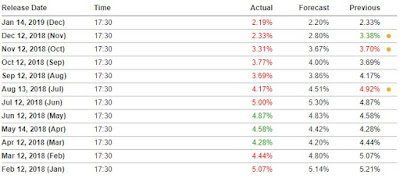

Head-line CPI in India came out at 3.15% YY, vs. 3.18% YY in the previous month. The rise in the July headline was driven primarily by four sub-indices, housing (4.9% YY), health (8%), meat (9.1%), and education (6.4%) respectively. Fruits (-0.9%), sugar (-2.1%), fuel (-0.4%), saw a decline on an annual basis. The comforting news here remains that Indian inflation has remained well below RBI's median target of 4%, for 12 consecutive months now.

Core inflation as conventionally measured (exclusion based) rose marginally to 4.3% YY (from 4.1% YY in June 2019). There is likely to be some consternation regarding this rise, albeit its small quantum, given that the increase comes after a 6 month falling trend in the core number.

However, it is this author's contention, and has been for quite sometime now, that the core measure being used is not optimal. As such, I would defer to my "true core" measure that is calculated by removing the actual volatile items from the headline CPI. Based on my true core* measure, core inflation has continued on its downward trajectory after peaking at 5.24% YY in October 2018. There is thus no real reason why monetary easing should be paused or reversed. The break between the core trend indicated by the government's measure, and my true core measure is clear from the chart below:

* for details of my true core measure, refer to my detailed post here.

In fact, both the volatile inflation, and true core inflation as calculated by me show that the downtrend in both types of inflation is strong. Neither of these measure have broken above the downtrend line that has been persistent for nearly five years now.

In conclusion the decline in inflation continues and is consistent with a slowing economy. The small bump in the government measured core inflation number is likely transitory and does not indicate any change in trend of prices. I believe my true core measure is a better indicator of price trends, and based on the same there really is no reason for the government or the RBI to pause their dovish stance.

Comments

Post a Comment