The crux of the core: On Inflation, Exchange rates and Interest cuts

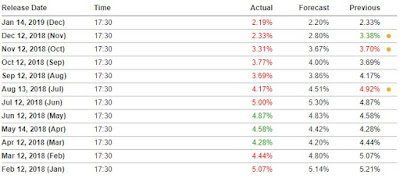

Summary: Significantly flattening yield curves coupled with extremely low inflation that is dampening business sentiment necessitates an aggressive cutting of interest rates in India in conjunction with other market friendly measures (scrapping LTCG and dividend tax on investments). However, the bogey of 'high core inflation' and 'weakening Indian Rupee (INR)' is raised by several analysts to argue against any rate cuts. I address both these concerns in the current blog post. It is my view that the current measure used to track core inflation is not accurately measuring the same. A " true core " inflation measure calculated by me shows that actual trend inflation is not only stable, but also likely well below current estimates. On the INR front, I believe that credit market stress in the USA will lead to a slowdown in Fed's belt-tightening plans causing the INR to be on a relatively stronger footing. There thus remains very little ground to postpone ...