September 2019 Inflation print, nothing alarming

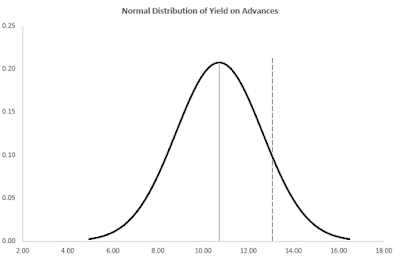

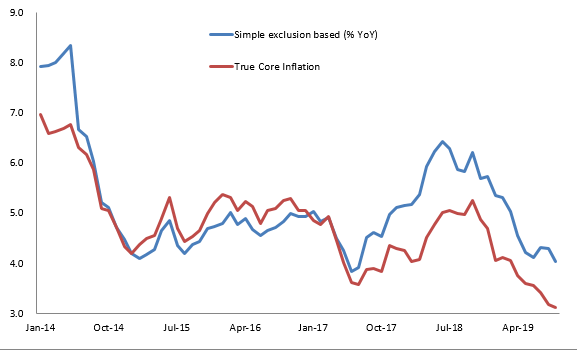

The latest reading of the Indian CPI (Sept 2019) came out at 3.99%. This may cause some re-think within policy circles on the current rate reduction cycle. However, a closer look at the data suggests that there is nothing alarming about this print. First, it is still slightly below the target inflation of 4% (-/+ 2ppt). Second, the core inflation, even as its calculated using exclusion method has actually come down from 4.3% in Aug19 to 4% in Sept. Finally, if we were to use my true core measure (i.e. excluding items based on their actual volatility and not just the food+fuel exclusion), then the core inflation has come down to 3.11% in Sep-19 from 4.69% in Dec-18. In fact the core inflation continues its downtrend unabated as seen below: The rise in inflation in September 2019 was due to a surge in volatile items. Notably, despite this surge the volatile inflation has not broken above the technical downward trend line. Given where it is poised today, I believe it will ho