September 2019 Inflation print, nothing alarming

The latest reading of the Indian CPI (Sept 2019) came out at 3.99%. This may cause some re-think within policy circles on the current rate reduction cycle. However, a closer look at the data suggests that there is nothing alarming about this print.

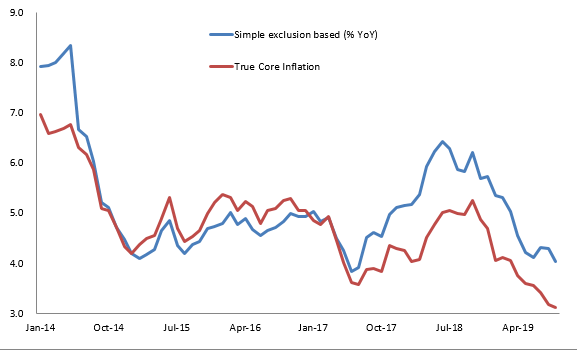

First, it is still slightly below the target inflation of 4% (-/+ 2ppt). Second, the core inflation, even as its calculated using exclusion method has actually come down from 4.3% in Aug19 to 4% in Sept. Finally, if we were to use my true core measure (i.e. excluding items based on their actual volatility and not just the food+fuel exclusion), then the core inflation has come down to 3.11% in Sep-19 from 4.69% in Dec-18. In fact the core inflation continues its downtrend unabated as seen below:

The rise in inflation in September 2019 was due to a surge in volatile items. Notably, despite this surge the volatile inflation has not broken above the technical downward trend line. Given where it is poised today, I believe it will hover here, and perhaps even decline as soon as the festive season is over.

The key culprits of this rise within my volatile inflation index universe were three items, vegetables, pulses, and housing, which cumulatively weigh 18.5% of the original total index, and rose 15.3%, 8.3%, 4.7% respectively.

Of these, I would not worry too much about pulses and housing. This is because last year, pulses had a very bad run from December 2013 to March 2019. As such, the rise now may just be a normalization to long term price trend. Even for housing, the inflation is largely in line with its long term inflation trend.

The item to have a hawks eye on is vegetables. As you can see from the chart below the decline in vegetable prices started only after October 2018. This would mean that the inflation expansionary "base effect" will only begin to accelerate from now on.

As such the government needs to pay close attention to moderate vegetable prices to ensure that its impact does not vitiate the overall inflation number. In my opinion, this inflation print is nothing to be alarmed about, and the RBI should continue to ease interest rates going forward.

Comments

Post a Comment