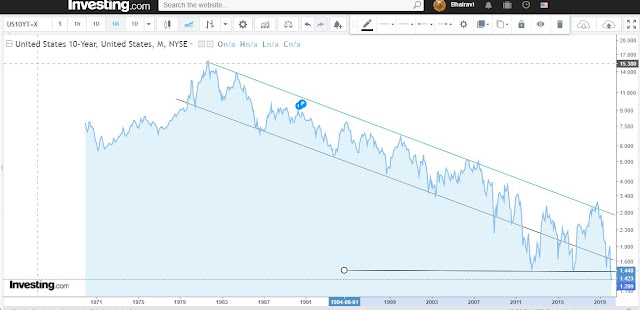

US Bond yield, treading water

This is a market that trades between US$ 500-600 billion a day, one of the most liquid markets in the world (behind the forex market). This is why the breach of a long term support or resistance has that much more significance, because more traded the security the more credible are its turning points. As you can see from the below chart, the US benchmark 10 year yield has largely followed the discipline of its long term trend lines. The collective greed and fear of the markets is more completely reflected in the bond markets than in the equity markets, since large institutions like banks, insurance companies, central banks etc. (what are considered as sophisticated investors) trade in this market. Even more so the US Bond market that is considered the safest yield bearing asset and often a refuge for investors fleeing uncertainty. Primer: Bond yields are inversely related to the price of the bonds. When bond price rises, the yields fall, and vice versa. Bond pr...