US Bond yield, treading water

This is a market that trades between US$ 500-600 billion a day, one of the most liquid markets in the world (behind the forex market). This is why the breach of a long term support or resistance has that much more significance, because more traded the security the more credible are its turning points.

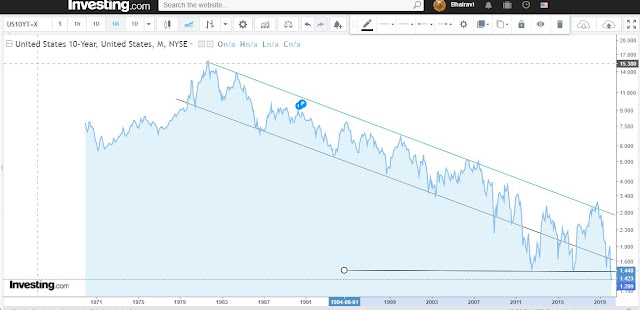

As you can see from the below chart, the US benchmark 10 year yield has largely followed the discipline of its long term trend lines. The collective greed and fear of the markets is more completely reflected in the bond markets than in the equity markets, since large institutions like banks, insurance companies, central banks etc. (what are considered as sophisticated investors) trade in this market.

Even more so the US Bond market that is considered the safest yield bearing asset and often a refuge for investors fleeing uncertainty.

Primer: Bond yields are inversely related to the price of the bonds. When bond price rises, the yields fall, and vice versa. Bond prices (or any price really) rise when demand exceeds supply. Demand for US Govt bonds increases when investors want a risk free asset to hold to ride out any feared turmoil. Ergo, unnaturally falling yields suggest that something has spooked some of the most well informed minds in the world.

From personal experience this author might even say that the first inkling that something was 'off' pre GFC was when in mid 2007 the bond yield peeked just above the long term support. You might see it if you zoom in around May or June 2007 (its been dwarfed by even bigger moves since). The sheer amount of liquidity that would take to move it beyond its technical lines means these moves are not be taken lightly.

Since then of course the bond yield well below the trendlines on two occasions before the current. In 2016 it was the ISM Index contracting and initial Brexit fears, while in 2012 it was European Debt Default. All extraordinary events. However the yield did find a base around 1.35%, a level it held through the earlier crises over the past 8 years. Curiously the past two really low moves were both in the election year for America.

Till now anyway. The yield tested the old support level a few times over the past week and then finally breached it. Even though the yield may finally close above the long term support, the fact that it moved out of such a long held support is itself intriguing, and worth paying attention to, especially by Finance Ministers and Central Bankers.

I just want to let you know that I just check out your site and I find it very interesting and informative.. Best etf investing

ReplyDelete