The crux of the core: On Inflation, Exchange rates and Interest cuts

Summary: Significantly flattening yield curves coupled with extremely low inflation that is dampening business sentiment necessitates an aggressive cutting of interest rates in India in conjunction with other market friendly measures (scrapping LTCG and dividend tax on investments). However, the bogey of 'high core inflation' and 'weakening Indian Rupee (INR)' is raised by several analysts to argue against any rate cuts. I address both these concerns in the current blog post.

It is my view that the current measure used to track core inflation is not accurately measuring the same. A "true core" inflation measure calculated by me shows that actual trend inflation is not only stable, but also likely well below current estimates. On the INR front, I believe that credit market stress in the USA will lead to a slowdown in Fed's belt-tightening plans causing the INR to be on a relatively stronger footing. There thus remains very little ground to postpone the necessary rate cuts.

The Consumer Price Index (CPI) came out at 2.2% YY for the month of December 2018 coming slightly below analyst expectations. In fact, the CPI has come out below expectations for nine out the previous twelve months.

Source: investing.com

This author has been highlighting the excessive control of inflation for sometime now, most recently here. The key issue for me is that the steady 7-8% GDP growth has come mostly out of inflation control rather than acceleration of nominal growth.

Apart from the dampening of animal spirits that generally accompanies tepid nominal growth, there is the empirical reality that cost control (inflation reduction) cannot go on forever. With the gap between nominal and real GDP growth near its decade lows, the economy exposed to the risk of an inflation shock that will cause a disproportionate impact on real growth numbers.

Source: Press note on National Accounts Statistics Back Series Base 2011-1, CSO (data)' Analysis: self

Couple this with a yield curve that has noticeably flattened over the last six months, and appears to have even marginally dipped downwards at the long end over the last month or so, raises the urgency of deep and swift rate cuts, and also some other mood elevating measures such as removal of dividend tax and removal of capital gains on equities.

Source: WGB

With respect to rate cuts, a key consideration that appears to be holding the RBI back is the high 'core inflation' number despite the significant fall in headline CPI as we have seen earlier.

What is core inflation?

What is core inflation? Core inflation is basically the headline inflation minus the inflation in volatile items. By removing the inflation in volatile items, core tries to arrive at that part of inflation that is the true trend. Eg: fuel px is volatile. If crude spikes then, so will inflation. However, policy cannot be dictated by sudden and transient changes in prices. So core inflation is a measure that attempts to remove volatile price movements from the headline inflation number to arrive at the base trend of inflation.

While there are multiple methods for calculating core inflation, the most common is the exclusion method that is also used in India. This method is a heuristic which involves removing food and fuel inflation from the headline inflation to arrive the core inflation. The popularity of this method is primarily due to its simplicity which makes explaining it to the public easier versus using a statistics heavy methodology.

Note, core number appears to be released by the government every quarter, so I have manually calculated it from the monthly indices available and for the quarter end months, it is a very close approximation of the released number (the long term average of both, the released statistic and my calculated statistic, is the same 5.2%). For those interested in seeing individual divergences can expand the chart below.

Note, core number appears to be released by the government every quarter, so I have manually calculated it from the monthly indices available and for the quarter end months, it is a very close approximation of the released number (the long term average of both, the released statistic and my calculated statistic, is the same 5.2%). For those interested in seeing individual divergences can expand the chart below.

My manually calculated core inflation in the chart below using the exclusion method comes to 5.7% (govt number is 5.9%) vs. headline inflation of 2.2%.

Core inflation = Headline Inflation - Food Inflation - Fuel Inflation

Source: India Macro Advisors Inc (data); Analysis: Self

If analyst speculations that RBI is focusing on core inflation to decide rates is correct then this author would disagree with this stance of the Bank. Core inflation cannot replace the cost of living as a measure of inflation. Especially in a country like India where cost of food and fuel (typically excluded from headline inflation to arrive at core inflation) are a large part of households (HHs) budget. In fact of the 23 inflation targeting countries in 2011, only five (Canada, Sweden, Thailand, Norway, & New Zealand) focused on core inflation.

To check whether core inflation is indeed as high (5.7-5.9%), as it is being currently calculated, I manually calculated the measure using each of the individual 23 items that go into the blended CPI measure.

Instead of simply excluding the 'rule of thumb' metrics of food and fuel, I calculated the contribution of each of the constituents to total index variance over the past 60 months cumulatively.

The contribution of a constituent to total variance equals the summation of the multiplication between the weight of the constituent whose contribution is being measured, the weight of each constituent, and the co-variance between the constituent being measured and each constituent.

I noticed that just seven constituents with a total weight of ~43% accounted for ~80% of the total index variance. These then formed part of my volatile inflation index, while the remaining constituents became, what I call my, true core inflation measure. Notably only 6 items (~33% weight) out of the food & beverage basket (total ~45% weight) make it to my volatile inflation list. Fuel inflation does not make it to the volatile list at all! This does raise some questions on the methodology that India is using to calculate inflation today and one wonders if policy makers should be re-looking at this index afresh.

As per a paper by Raj and Mishra for RBI (Vol 32, No. 3, Winter 2011, Page 42), a good measure of core inflation should have three properties:

a) Core measure should be less volatile than headline inflation

b) Over the long term, core inflation rate should match headline rate with no systemic divergence. It should be able to track the trend rate of inflation

c) It should be able to better predict the headline inflation rate

I tested my 'true core' measure against these three points/ conditions to ensure that it performs better than the current core measure being used.

Source: Self

The contribution of a constituent to total variance equals the summation of the multiplication between the weight of the constituent whose contribution is being measured, the weight of each constituent, and the co-variance between the constituent being measured and each constituent.

I noticed that just seven constituents with a total weight of ~43% accounted for ~80% of the total index variance. These then formed part of my volatile inflation index, while the remaining constituents became, what I call my, true core inflation measure. Notably only 6 items (~33% weight) out of the food & beverage basket (total ~45% weight) make it to my volatile inflation list. Fuel inflation does not make it to the volatile list at all! This does raise some questions on the methodology that India is using to calculate inflation today and one wonders if policy makers should be re-looking at this index afresh.

As per a paper by Raj and Mishra for RBI (Vol 32, No. 3, Winter 2011, Page 42), a good measure of core inflation should have three properties:

a) Core measure should be less volatile than headline inflation

b) Over the long term, core inflation rate should match headline rate with no systemic divergence. It should be able to track the trend rate of inflation

c) It should be able to better predict the headline inflation rate

I tested my 'true core' measure against these three points/ conditions to ensure that it performs better than the current core measure being used.

As one can see, not only is my measure of true core inflation less volatile than the current measure of core inflation (CV of 0.16x vs. 0.21x), it also fits in tighter with headline inflation (correlation coefficient of 0.73 vs 0.63 for current core metric) and explains more of headline inflation (R square of 54%) than the present core inflation metric (R square of 40%).

Source: Self

An important consideration for me in preferring my true core measure is also the weak relationship between money supply (M3) and core inflation as it is currently measured. Long term change in price of a good is determined by structural changes in supply and demand, not by monetary policy. Computer chips are cheaper today than they were in 1980s not because of monetary policy but because of structural changes (technology advancement, more suppliers etc).

Hence if interest rates are being held high to control core inflation, then the implicit assumption is that this price measure is indeed impacted by liquidity. Therefore, core inflation is the measure over which monetary policy has the most influence [Roger (1997); Shiratsuka (1997); from the RBI paper by Raj and Mishra mentioned earlier]. As such, a strong relationship between liquidity and non-volatile (i.e. core) inflation must exist if it is to serve as the basis for a hawkish rate stance.

Even on this metric, my true core (R squared of 31%) measure has a stronger response to %YY change in M3 than the current core measure (R squared of 12% only). As such, if at all monetary policy is being framed using the current core inflation metric then it is akin to pushing on a string in terms of the impact.

Source: Self, (based on quarterly data since March 2014)

Source: Self

An important consideration for me in preferring my true core measure is also the weak relationship between money supply (M3) and core inflation as it is currently measured. Long term change in price of a good is determined by structural changes in supply and demand, not by monetary policy. Computer chips are cheaper today than they were in 1980s not because of monetary policy but because of structural changes (technology advancement, more suppliers etc).

Hence if interest rates are being held high to control core inflation, then the implicit assumption is that this price measure is indeed impacted by liquidity. Therefore, core inflation is the measure over which monetary policy has the most influence [Roger (1997); Shiratsuka (1997); from the RBI paper by Raj and Mishra mentioned earlier]. As such, a strong relationship between liquidity and non-volatile (i.e. core) inflation must exist if it is to serve as the basis for a hawkish rate stance.

Even on this metric, my true core (R squared of 31%) measure has a stronger response to %YY change in M3 than the current core measure (R squared of 12% only). As such, if at all monetary policy is being framed using the current core inflation metric then it is akin to pushing on a string in terms of the impact.

Source: Self, (based on quarterly data since March 2014)

Now that the validity of my true core measure has been established, per my calculations the volatile inflation measure is already in negative territory with a print of -0.8% YY in November and -0.9% YY in December 2018. Unlike the last time when it dipped into the red (in June 2017) the volatile index has not bounced back immediately and is currently at its 60 month low.

Source: India Macro Advisors (data); Analysis: Self

The true core portion of inflation has remained largely steady, remaining within the bounds of plus/minus 1 standard deviation, and appears to exhibit mean reversion tendencies. In fact, even in absolute terms, my true core inflation measure is at 4.8%, sharply below the 5.7-5.9% ticker on the official data.

This is in contrast to the current core measure that has been relatively volatile, perhaps vitiating policy making. CV of true core has been 0.16 versus 0.21 for the current exclusion based index.

Source: India Macro Advisors (data); Analysis: Self

Thus it is clear that the true core index calculated by me appears to be serving the function of a core inflation index better than the measure being used in India today. Based on my better measure, there is no doubt in my mind that inflation control in India may have been over done, and is now in fact counter productive to the long run growth prospects of the economy.

Lack of nominal growth will create a negative feed back loop that will curtail the pace of GDP growth starting over the next few quarters. Any spike in inflation in such a scenario will be substantially unfavourable for the economy at large. If the government is concerned about sudden spikes then it should focus on the items in my volatile inflation index (composition will be provided upon request by them) more than the core index as the true core has remained fairly stable, and may in fact be about 100bps lower than what is being estimated based on the current measure.

Lack of nominal growth will create a negative feed back loop that will curtail the pace of GDP growth starting over the next few quarters. Any spike in inflation in such a scenario will be substantially unfavourable for the economy at large. If the government is concerned about sudden spikes then it should focus on the items in my volatile inflation index (composition will be provided upon request by them) more than the core index as the true core has remained fairly stable, and may in fact be about 100bps lower than what is being estimated based on the current measure.

The other reason cited for not cutting rates is the impact of lower rates on an already weakening currency. For this, we need to look at what is happening in the US market. The view below is based on work by strategist Christopher Wood. The Fed balance sheet that peaked at US$4.5tr as been steadily contracting since the normalisation programme began in October 2017. The Fed balance sheet is expected to contract by US$50bn per month over the coming year. In conjunction with this B/s contraction, the Fed has been steadily raising rates as well. From nearly zero around the end of 2015, rates have increase to 2.4% currently.

Source: US Fed

Unsurprisingly, this has led to a sharp appreciation in the $ index. (DXY is a index that measures US$ strength vs a basket of ccys). DXY is up 18-20% over last 5 years or so.Strength of US$ makes manufacturing in USA to export an nonviable affair, which is not something that fits in with the current POTUS's policy. It would be in the political leadership's interest to see a weaker US$.

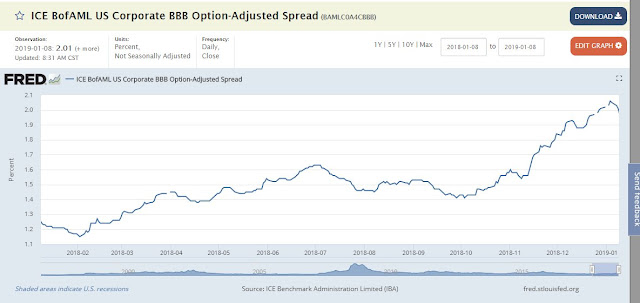

Interestingly, this liquidity tightening has led to a spike in the spreads of BBB bonds. BBB is the rating that is the lowest a bond can be downgraded to without it being considered as a junk/ high yield bond. Spreads here have jumped nearly doubled.

BBB bonds are nearly 50% of US bonds o/s by some estimates. Not only that, the net leverage of Cos that issue these BBB bonds has also increased from 1.7x to nearly 3x in 2017. In fact Investment Grade is now a very small part of the market. Therefore, any stress here can spark of an adverse chain reaction in the credit markets.

Source: Bloomberg & Pimco

As such, it is my belief that while policymakers are bracing for a continued tightening in the US market, the reality will be quite different. USA cannot afford another credit market crisis and therefore is likely to ease their liquidity tightening sooner than expected to achieve the twin objectives of a) easing its currency strength and b) protecting credit quality in its bond bourses.

Therefore, it is my belief that INR will outperform the US$ over the next 12 months and gives enough room for India to aggressively cut rates.

Anirudha V Limaye

Anirudha V Limaye

On the eve of polls, parties have started a digital media war. With the Election Commission approving 40 short videos, the ruling AIADMK has hit out at the DMK for its failures and misdeeds. The videos also list out the achievement of the AIADMK governments headed by J Jayalalithaa in the past and Edappadi K Palaniswami now.

ReplyDeleteSmart card service in singanallur

Apply smart card in singanallur

Online pan card service in singanallur

Voter id verification in singanallur

Online apply for voter id card in singanallur r

Voter ID Registraion in Singanallur