India & Covid19: A Long Term Influenza

Life is what happens to you while you are busy making other plans

John Lennon

History tends to fashion itself in a way that is quite different from what people anticipate. Till very recently, no one seriously factored in the possibility of the China story being virtually derailed on account of a viral outbreak (re the Covid19 virus). Consequently, the world was blindsided by this and today the declared cases stand at 92,818, with unofficial numbers of the infected at many multiples of this estimate.

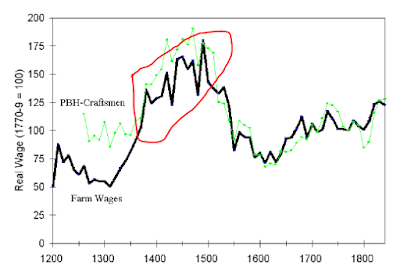

This author has written extensively on why a ‘Chinese future’ is less likely than what is generally believed, and also on the deep long term impact that diseases have on society:

The analysts at Dun & Bradstreet estimate that there are about 22 million businesses in the regions impacted by Covid19, which will directly or indirectly have a knock-on effect on 56,000 companies worldwide. In fact Dun & Bradstreet recently downgraded China's risk rating on the back of the public health emergency, with a "deteriorating" outlook.

India too will not remain unscathed in the tragic global outbreak. However the impact on India will be decidedly mixed, and very different from the near term to the longer term. The most obvious near term impact will be the fall out of the "flight to safety" reaction of global money. "Flight to safety" is the tendency of global investors to sell off their interests in riskier assets, and park their funds in safe, highly liquid instruments like US Treasuries to ride out turbulent periods. This is already evident in the benchmark US yield falling below 1%, a level that it had not breached even in the throes of the sub-prime crisis in 2008-09.

Emerging economies like India are the collateral damage of this global "risk-off" trade and it is not surprising to see FII/FPI investments being sold off, and Indian equities bearing the brunt thereof. Indian markets are down ~8% since the beginning of 2020, and FII's have been net sellers of nearly Rs 220 billion over the same period. With the true extent of Covid19 damage yet to be known, it is unlikely that this weakness in the markets will abate anytime soon.

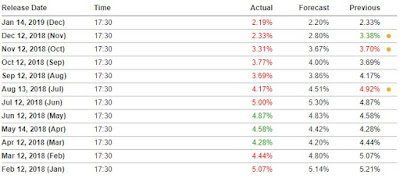

This squarely impacts the Government of India's (GoI) divestment plans. GoI intends to raise Rs 2.1 trillion via sale of marquee assets like Life Insurance Corporation, Air India, etc. Subdued sentiment is detrimental to realizing a fair value for its assets, and GoI may be forced (and perhaps, well advised) to put its divestment plan on the back-burner. Divestment proceeds were expected to account for about half of non-debt receipts in FY 2021, and slowdown here may expand the government's borrowing programme. Additionally, lower global demand will impact domestic earnings, reducing the government's share in the form of taxes. For perspective, it is worth noting that the growth in direct taxes in aftermath of the Global Financial Crisis in 2008-09, fell to 6.9% YoY, from 35.6% YoY a year before. Needless to say, that the fiscal deficit target of 3.5% (of GDP) is at risk.

A positive macro effect could be the lowering of India's oil import bill as international crude prices decline on the back of the global softening. With 85% of India's crude oil demand being imported (oil accounts for over a fifth of India's imports), global oil prices are a key driver of India's current account deficit. Softening of oil prices will likely meaningfully reduce India's oil import bill. Some estimates peg the FY 2021 oil imports to be US$ 85 - 90 billion (if oil prices stabilize near current levels), vs. a US$100 billion+ figure in the current fiscal. The savings however may be pared by a weaker Indian Rupee, as the aforementioned 'flight to safety', bolsters the demand for, and thus the strength of, the US Dollar. The Indian Rupee will no doubt be further weakened as the Reserve Bank of India is likely to resume is dovish rate strategy to support the economy going forward.

However the most talked about impact of Covid19 is the chilling effect it has had on global supply chains that centered around China. Estimates peg over 50,000 companies being impacted globally, of which 143 companies feature in the Fortune 500, having at least one 'tier-1' supplier in the affected region.

Notably, India does not plug into this chain and thus may have a degree of natural insulation from this crisis (China accounts for only about 5% of India's exports). However, import dependency is a concern with China accounting for 14-19% of India's non-oil imports. The most vulnerable sectors are electrical appliances/ parts, and chemicals where imports from China account for 37% and 41% of their total import value. India's mobile phone manufacturing sector (one of the largest in the world) will be impacted by any slowdown in imports of parts from China. Chemicals/ pharma is another vulnerable sector, prompting the Indian government to restrict exports of 26 drugs, that though manufactured in India, are dependent on ingredients imported from China with few alternative suppliers.

Detailed break-up of India's industry-level import linkages can be seen below:

In effect, the near term impact of Covid19 on India is a mixed bag, tending to the negative as sentiments falter, and established chains of businesses are stretched. However, this author believes that the longer term impact of this crisis may will show India in a positive light to the global community. The first, and most important take-away is that India has (so far) managed to limited the domestic cases of Covid19 to a handful. Additionally, the alacrity it showed in evacuating its citizens from affected areas underlines India's increased willingness to assert itself on a global platform.

The most significant fall-out of the crisis will be reflected in a mindset change of how global businesses look at their supply chains. Plans to diversify China-centric logistics will pick up pace, and India with its large population, low labour costs, increased electricity availability, and a friendly tax regime for setting up new production units, may well emerge as an attractive alternative destination. The silver lining in the current gloom is that it presents India with a tangible opportunity to stake claim on global manufacturing, a bus that it had missed in the 1990s. A proactive government can work on attracting supply chains looking for an alternative home, and creating an conducive environment for them. As such, this author does not share the gloom & doom prophecies of many observers. Covid19 has been a disruptive force no doubt, but the brunt of a disruption is usually borne by the incumbent, while to others it presents an opportunity. If the Indian government can look past the immediate turmoil, and steer the economy with market friendly decisions, this may well be India's opportunity to lose.

Comments

Post a Comment