The curious case of Raghuram Rajan

Rahguram Rajan (RR) is indeed a well known personality from the field of global economics. The son of a bureaucrat in India, RR went on to study in some of the most elite universities in the world. He came to be associated closely from Indian economic policy-making in 2007 when he worked with Montek Singh Ahluwalia on financial sector reforms. In 2008, he assumed the role of honorary economic advisor, a role he presumably served till his appointment as the Chief Economic Adviser to the Indian Ministry of Finance. In 2013 he took over as the governor of the Indian central Bank, the Reserve Bank of India and remained in the role till 2016 when reportedly his teaching duties in the USA beckoned and he left. While, this description can be read by anyone on RR's wiki page (as I have), the point I endeavor to make here is that RR was closely associated with India's economic policy at the very highest levels from 2007 to 2016, nearly a decade. He also has the distinction of being perhaps the only economist with a mainstream following from among the glitterati of India.

Nowadays however it is refreshing to see RR finding time from his onerous teaching duties to enlighten us with his views on the Indian economy. Why, just the other day RR "issued a warning" on the economic slowdown. For good measure, he also drew attention to the possibility of India's GDP being 'overstated' as presented by his friend Arvind Subramanian (who incidentally had this insight almost immediately after resigning from Indian policy making positions). While this is only the latest in a series of advisories from him, I have no doubt that Indian economic thought has been richer from his regular commentary since his departure.

It is now well understood that apart from the global slowdown, a large part of Indian economic issues are a result of a NPL (Non Performing Loans) crisis at Indian banks. A problem that is widely seen to have originated between 2005-2011.

In fact sometime late in 2018, RR had written a letter to a parliamentary panel on the causes of the bad loan crisis in India. In the letter he enlightened us on the causes of this problem. He lists, over-optimism, slow-growth, government red-tape, loss of banker/ promoter interest, malfeasance, and fraud, as some of the reasons. The letter is replete with Rajan-isms like " it is hard to tell banker exuberance, incompetence, and corruption apart" and highlights the problems plaguing the Indian banking industry.

While this author does not have the academic credentials of RR, it would appear that the first four reasons (italicized) are generic and not the key cause of the magnitude of the asset quality problem. I believe the problem lay more in the malfeasance and fraud aspects mentioned earlier. I base this on the simple fact that the first four reasons are generic in nature, and thus applicable to both the private banks and public sector banks. However, there is a clear divergence in the trend of Gross NPLs (in % terms) in both, suggesting that it was a ethics issue, and not an economic one.

Source: RBI data, Working Paper 200 Institute of Studies in Industrial Development by Das/ Rawat (March 2018)

Surely the argument cannot be that in % terms the over optimism, or slow growth, etc impacted public sector banks at a vastly greater scale than private banks? Nor can it be said that ordinary individuals running these private banks (and even MNC banks) were somehow consistently able to do a much better job than the government officials running public sector banks, and the civil servants supervising them.

It can then be surmised that a significant of these NPLs were due to loans being given to unscrupulous borrowers by bankers, who were either deceitful or were under some pressure to extend these loans. The 'pressure' argument makes sense because private bankers and MNC bankers are less amenable to political pressure.

It is worth noting at this stage that various articles say that this problem (of unscrupulous lending) was during the period 2005 to 2011. While I am not commenting on the political masters, I am interested in how RR dealt with this issue. The runaway credit growth was not really a secret at this time. The Non Food Credit growth outpaced the Nominal GDP growth at an accelerating clip around this period, should surely have been picked by an economist with impeccable credentials in my opinion.

Source: RBI data, Working Paper 200 Institute of Studies in Industrial Development by Das/ Rawat (March 2018)

After all as I mentioned in the introductory, RR was closely associated with Indian economic policy for almost the entire period. Did he highlight the issue then? While it is unfair to expect him to reveal how he privately advised the politicians, one can look at the sole Economic Survey of India for the year 2012-13 authored by him. Here are some excerpts from the same:

Source: Economic Survey 2012-13

In these excerpts we see that RR did not seem overly concerned with the NPL issue. In fact says that they are partly higher due to "technical issues", and are at "manageable levels". Other reasons highlighted are generic economic slowdown issues. This is really surprising since by FY13, stressed assets as a % of networth for PSU banks were well over a 100%

Source: Assocham/ PwC report

Even the referrals to corporate debt restructurings had spiked in just a couple of years.

Source: Assocham/ PwC report

Despite these signs from the time, RR seems to be remarkably calm in his Economic Survey. Perhaps we are not used to understatement, but surely the state of affairs should have piqued his interest enough to wonder if everything was above board? Yet, he seems to not have suspected any malfeasance.

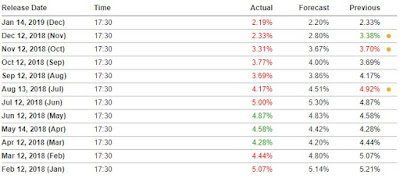

However, the above can certainly be rationalized by saying he did not have any access to banking data or information in FY12-13. He did become the RBI governor in September 2013, when he proceeded to raise policy rates from 7.5% to 8.0% and keep them there for about a year:

Source: RBI, India Macro Advisors

This was an interesting move, i.e. raising/ maintaining rates on one hand while injecting liquidity thorough Open Market Operations (OMOs) on the other. (this continued till quite recent times actually):

Source: Economic Times

Now it is also true that RR initiated the Asset Quality Review (AQR) that started the process of identifying these fraud/ malfeasance driven stressed assets. If memory serves, this began in August 2015, nearly two years after RR took on the role of RBI governor, and when nearly 2/3rd of his term was over. Certainly intriguing.

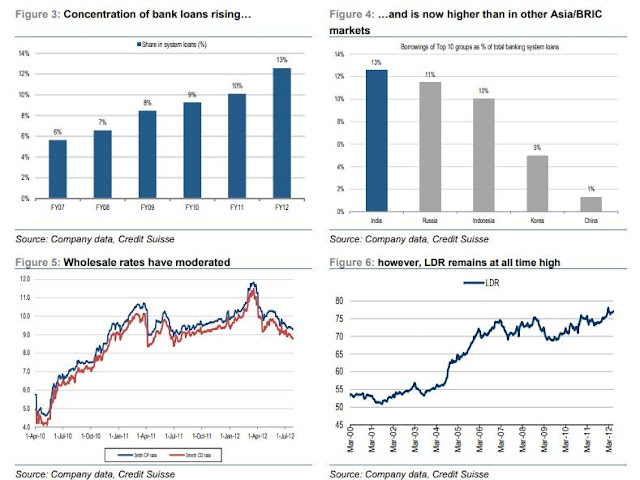

This is particularly intriguing because, even analysts with some brokers had began to highlight this problem with some urgency much before then. The most noteworthy report was called House of Debt, by analysts at Credit Suisse. This report had come out in August 2012, and was written by some smart analysts despite likely having less access to information vs. a Chief Economic Adviser, for instance. I will use just some of the charts from the report below, to highlight the fact of how difficult it was to not be able to see this problem in 2012 itself:

Certainly far be it from me to cast aspersions on Rajan's motives, or ability. That it not my intent, and should certainly not be imputed from this note at all. I am only fascinated how someone who is so intelligent, and generous to a fault (after all he does still give his views and advises on Indian economic matters despite not being in any way required to), can seemingly not notice such glaring signs.

Hindsight is of course 20-20 as they say, hence I have tried to include only such data that would be available to RR at the time and not with the benefit of time.I write this note not to highlight RR's shortcomings (that is not my place), but as a reminder to ordinary folk like us, to not be blindsided by something that is so obvious much in advance. Because all the pontificating after the moment has passed will not whitewash your lack of action when it mattered.

Source: RBI data, Working Paper 200 Institute of Studies in Industrial Development by Das/ Rawat (March 2018)

After all as I mentioned in the introductory, RR was closely associated with Indian economic policy for almost the entire period. Did he highlight the issue then? While it is unfair to expect him to reveal how he privately advised the politicians, one can look at the sole Economic Survey of India for the year 2012-13 authored by him. Here are some excerpts from the same:

Source: Economic Survey 2012-13

In these excerpts we see that RR did not seem overly concerned with the NPL issue. In fact says that they are partly higher due to "technical issues", and are at "manageable levels". Other reasons highlighted are generic economic slowdown issues. This is really surprising since by FY13, stressed assets as a % of networth for PSU banks were well over a 100%

Source: Assocham/ PwC report

Even the referrals to corporate debt restructurings had spiked in just a couple of years.

Source: Assocham/ PwC report

Despite these signs from the time, RR seems to be remarkably calm in his Economic Survey. Perhaps we are not used to understatement, but surely the state of affairs should have piqued his interest enough to wonder if everything was above board? Yet, he seems to not have suspected any malfeasance.

However, the above can certainly be rationalized by saying he did not have any access to banking data or information in FY12-13. He did become the RBI governor in September 2013, when he proceeded to raise policy rates from 7.5% to 8.0% and keep them there for about a year:

Source: RBI, India Macro Advisors

This was an interesting move, i.e. raising/ maintaining rates on one hand while injecting liquidity thorough Open Market Operations (OMOs) on the other. (this continued till quite recent times actually):

Source: Economic Times

Now it is also true that RR initiated the Asset Quality Review (AQR) that started the process of identifying these fraud/ malfeasance driven stressed assets. If memory serves, this began in August 2015, nearly two years after RR took on the role of RBI governor, and when nearly 2/3rd of his term was over. Certainly intriguing.

This is particularly intriguing because, even analysts with some brokers had began to highlight this problem with some urgency much before then. The most noteworthy report was called House of Debt, by analysts at Credit Suisse. This report had come out in August 2012, and was written by some smart analysts despite likely having less access to information vs. a Chief Economic Adviser, for instance. I will use just some of the charts from the report below, to highlight the fact of how difficult it was to not be able to see this problem in 2012 itself:

Certainly far be it from me to cast aspersions on Rajan's motives, or ability. That it not my intent, and should certainly not be imputed from this note at all. I am only fascinated how someone who is so intelligent, and generous to a fault (after all he does still give his views and advises on Indian economic matters despite not being in any way required to), can seemingly not notice such glaring signs.

Hindsight is of course 20-20 as they say, hence I have tried to include only such data that would be available to RR at the time and not with the benefit of time.I write this note not to highlight RR's shortcomings (that is not my place), but as a reminder to ordinary folk like us, to not be blindsided by something that is so obvious much in advance. Because all the pontificating after the moment has passed will not whitewash your lack of action when it mattered.

Another very interesting read!

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete