Semiconductors: An underappreciated strategic resource

'If you've got them by the balls, their hearts and minds will follow.'

- Quote sometimes attributed to Theodore Roosevelt

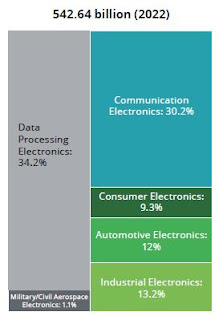

Semiconductors are the unsung heroes of today’s tech revolution. Whether it is end products such as smartphones, tablets, phablets, PCs, Macs, etc., or applications such as search engines, operating systems,the workhorse remains the semiconductor. Semiconductors are the heart of civilian and military applications alike, and thus in my view a key (albeit relatively ignored) strategic resource. See below chart for estimated use mix per Gartner, Deloitte:

For a product that is so embedded in our day-to-day life, and likewise critical to military applications, including high performance computing, AI, and IoT, the entire semiconductor ecosystem is rather tightly controlled by a small group of companies.

For example, only two companies manufacture the most advanced semiconductors at scale: Taiwan Semiconductor Manufacturing Company (TSMC), and Samsung. Even between the two, TSMC is considered the leading player.

Even the software that an engineer would use to design a semiconductor is duopolistic, being dominated by two companies: Synopsys, and Cadence Design Systems. As is the rest of the supply ecosystem where applied materials are dominated by LAM Research, KLA, and Tokyo Electron, and equipment is dominated by a single Netherland based company called ASML.

One of the reasons for the concentration in the semiconductor ecosystem is the extremely high precision engineering involved with making a chip. Semiconductors are manufactured using a process called ‘photo lithography’ that is often perceived as the pinnacle of human achievement in precision engineering. In this process, light is used to etch a pattern on a silicon wafer which allows for tiny space to be left between transistors placed on the wafer. The finer the etching, the more the transistors that can be placed on the same wafer, the higher the performance of the end chip.

Today chip manufacturers (called foundries) are making etchings that are just 7 nanometers apart, and are even approaching 5 nanometers. To give context to this size, a 5-nanometer thin etching means there are just 10-15 atoms of silicon between the transistors placed on that chip. The significance of going below 10 nanometers cannot be overstated as visible light has a wavelength of 190 nanometers, thus requiring companies to generate something called as extreme ultra violet (EUV) light of sufficient intensity to create these super fine etchings on the silicon wafer. Every instrument along this process chain, whether the lasers used to produce the EUV, or the mirrors used to reflect it onto the silicon, is at such a bleeding edge of technology that the process and IP is owned and protected by a handful of corporations. Notably, a single EUV system would need several transport planes and cost over US$200-300m making it a highly capital-intensive industry. The aforementioned Dutch company ASML is the world’s only commercial manufacturer of EUV lithography machines.

Per some commentators, the tech is so advanced that it does not lend itself to be readily reverse engineered either, as evidenced by China trying to unsuccessfully replicate TSMC’s products for over 20 years, despite investing tens of billions of US$ in the endeavor. Even foundries (such as those run by TSMC) that purchase this equipment need a lot of expertise and experience to use it to manufacture chips of high quality. By way of example, Intel Corp (a name that we most identify with microprocessors) was unable to produce 7 nanometer chips and has reportedly put off its next-gen chip programme for a few years. AMD’s foundry which was divested to a middle eastern sovereign wealth fund (UAE’s Mubadala) has not managed to best TSMC in its precision expertise, clearly indicating that this requires technological pedigree and is not a problem that one can simply throw money at.

China recognizes its vulnerabilities given that its entire programme of tech dominance (5G, AI, mobile, quantum, defence tech, etc.) depends on chips that it must buy from abroad. As such it had earmarked US$200bn to upgrade China’s capacity to manufacture these high-end semiconductors. However, despite efforts over years, it has been unable to close the technology gap with the likes of TSMC, or even Samsung and Intel.

USA too is moving fast to make up for the deficiencies in its domestic semiconductor manufacturing chain. While one is unaware of behind-the-scenes negotiations, TSMC was convinced to announce a US$12bn investment to set up a 5-nanometer foundry in Arizona in May 2020. Notably, USA accounts for 60% of TSMC’s revenue. China on the other hand is attempting to get TSMC to set-up similarly high-end foundries on the mainland, which the Company has managed to resist thus far.

The potential of using semiconductors as bargaining ‘chips’ is further evidenced by another rule that the US government introduced in May 2020. The rule requires foreign manufacturers using American chip-making equipment to get a license before they can sell semiconductors to Huawei. This rule has effectively cut off TSMC’s supplies to Huawei, and brings the very existence of Huawei’s smart phone division into question. Notably, China is now increasingly reliant on Israel for its supply of processors, and has even taken strategic stakes in various related Israeli companies.

However, the idea that a US$130bn revenue company, considered a national champion by China can be brought to its knees overnight with a stroke of a pen, is indicative of the disproportionate balance of power that the semiconductor ecosystem possesses

This now begs the question as to how is India placed to weather this situation. While this isn’t a new concern for this author, who first raised it in February 2017, the fructification of the fear of a foreign power actually using this lever has again brought it into focus. I am glad that the Indian government has taken some steps in this direction and has even as recently as last week invited EoIs from companies to set up semiconductor fabrication units within India. I believe that convincing TSMC to locate some high-end (5 or 7 nanometer) facilities in India with whatever sops are needed will be a step towards creating a strategic asset. Another step would be the Indian government or even Indian businesses taking stake in some key players along the semiconductor value chain. For example, taking a stake in ASML, which is the monopoly player for 5 nanometer EUV equipment, could be considered.

While India managed to successfully build a leading supercomputer in the ‘80s when a ‘Cray’ was denied to us by the then US administration, one fears that the semiconductor is an altogether different animal. India neither has the time, nor the resources to build a fabrication unit from the ground up, but locating a fab here in partnership with an established player like TSMC, in addition to strategic stakes in the value chain companies can help create a local ecosystem towards some level of self-reliance in this domain.

I disagree that India doesn't have the time/resources to build a fab. Of course TSMC's expertise would be the best that could happen but they've already invested in US for now. So it seems a little unrealistic to make that happen in India. Additionally, even if the process takes time to fructify, the applications are bounded only by imagination. So it would be a good idea to get a fab at any point of time in the future.

ReplyDeleteVery well written. Opens opportunities for us

ReplyDeleteThanks for the informative blog.

ReplyDeleteI am into embedded software development & have worked for 3 big Semiconductor companies so far.

In a way, it is amusing that general public doesn't have an inkling of how much Semiconductors have pervaded our lives and also how much sway a country can hold by having a dominance in Semiconductors.

I wish India gets a firm foothold in Semiconductor manufacturing, similar to vaccines.

Though vaccines are mostly developed outside, we are a leading manufacturer.

By the way there is a youtube video, in which the text from this blog was read out verbatim :) .

https://www.youtube.com/watch?v=Q_Oh_4fLNIE

Wow, this is good post, I have also seen this information here, electronics items

ReplyDelete