An Indian port for an European storm

Summary: Low/ -ve yield bonds in the Eurozone, high social spend, and a demographic time-bomb has compelled European Institutional money managers to venture into non traditional (and thus risky) asset classes. As a growth economy, even at subdued levels, India can offer a beacon of hope to this money searching for a return. The government should consider allowing the issuance of international bonds to address the NPL-driven capital constraints of Indian banks that can kick-start the next credit cycle. The current focus of the government on increasing taxes on risk capital, and compensating via own spend is an unsustainable model and patently unsuited to a young, entrepreneurial economy like India.

The entire German government bond yield curve dipped into negative territory this week, setting off alarm bells for the global economy.

For those unfamiliar with the yield curve, it is a plotting of yields that an investor might expect for buying bonds of different maturities. Generally, in a 'normal' economy, the yield curve is upward sloping with near term maturities (eg. 1 year bond) yielding less than the long term bonds (e.g. 10Y or 30Y). This is intuitive as an investor would like to be compensated more for locking up his money for a longer period of time.

While this author has been warning of the coming global crisis through tweets and papers sent to the Indian Ministry of Finance, the latest dip by German 30Y bonds is perhaps the wake-up call that was needed.

The negative rates in Germany, is barometer for the Euro region. Germany is after all one of he biggest economies accounting for ~30% of the euro region's GDP. It is worth noting that German GDP is expected to grow only at 0.5-0.8% YY in 2019, indicating the state of economic health for Europe.

What negative yield generally indicates is that the investor is so concerned with safety that he is willing to accept a small haircut just to protect a majority of his capital. So for example, a 10 Y German bond with a face value (redemption value) of EU100, with a annual coupon of say 0.25%, may be bought for EU110/- then the bond would yield a negative 0.71%. This means that the interest earned on the bond for 10 years is not adequately compensating for the excess paid over its redemption value.

The German situation is only an indicator of what is happening in the world today. Nearly US$15 trillion (yes, with a 'T') of global bonds are trading at 0-negative yields. This is nearly 25% of the investment grade debt tracked by the Bloomberg Barclays Global-Aggregate Index. And its accelerating, up over 55% from US$8.3 trillion just 6-8 months ago, and nearly 3x the levels from October 2018.

The mix is as follows (data available for Dec 2018 to June 2018, but I believe is representative):

Source: Bloomberg

Exacerbating the situation is that major interest rates in the world are already close to zero (India, USA are among the few countries that have bucked this trend, so far). This leaves little room for monetary action other than outright purchases of private debt/ equity.

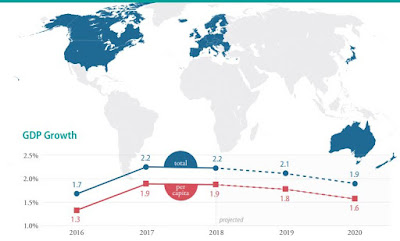

Global growth outlook for developed economies does not inspire confidence that the situation will reverse anytime soon:

Another heartening details is that households in India are not as leveraged cf. global peers indicating that given a favorable environment there is room for its populace to create demand by borrowing.

Source: MOSLThe mix is as follows (data available for Dec 2018 to June 2018, but I believe is representative):

Source: Bloomberg

Exacerbating the situation is that major interest rates in the world are already close to zero (India, USA are among the few countries that have bucked this trend, so far). This leaves little room for monetary action other than outright purchases of private debt/ equity.

Global growth outlook for developed economies does not inspire confidence that the situation will reverse anytime soon:

Source: un.org

The situation is especially grim in the Eurozone, where the inflation is expected to continue to see a precipitous decline.

The other side of this crisis is the pension crisis. Developed economies are not blessed with the most attractive demographics. This is in part reflected in the rising social spends that will likely be funded by increasing taxes and/or reducing developmental expenditure.

The other side of this crisis is the pension crisis. Developed economies are not blessed with the most attractive demographics. This is in part reflected in the rising social spends that will likely be funded by increasing taxes and/or reducing developmental expenditure.

Source: OECD

Falling growth coupled with human replacing technological developments are going to increase the burden on Institutional Asset Managers generally, and pension assets specifically. European Institutions have shifted their traditional asset mix to a riskier blend.

The Mercer Asset Allocation Survey from which the above charts are excerpted, are a good approximations of this change in mix. Allocation to bonds has sharply declined across the board, and is evident from the larger economies. German allocation to bonds declined from 68% in the 2013 survey to 34% for the 2019 survey. France's fell from 59% to 35%, and so on.

European dependency ratios are already near record highs and are expected to intensify over the next couple of decades. From a median age of ~40 years today, it is expected to rise to 52 years by 2050. There is tremendous pressure on pension fund managers to generate return to provide for this demographic time-bomb, and it is for this reason that Institutional allocation has been 'risked-up' as discussed earlier.

This provides a unique opportunity for developing economies like India. Currently, the government appears focused on generating funds via domestic taxation. But the problem faced is unique in the sense that, an unacceptably large % of existing debt on bank books is of inferior quality and is resulting in a capital constraint to fund future growth.

The silver lining here is that relative to global levels, India is not an highly leveraged country. As can be seen from the chart compiled by an Indian broker below, the overall debt of India is at approximately median levels for emerging markets.

Another heartening details is that households in India are not as leveraged cf. global peers indicating that given a favorable environment there is room for its populace to create demand by borrowing.

However, coming back to what appears to be the Government policy of increasing taxation to fund spending, not only has a crowding out effect, but also has a chilling effect on the willingness of entrepreneurs to take risk. As discussed in an earlier note of mine, "An Absence of Euphoria", the falling nominal growth compounded by the perceived hawkish stance by the government's finance ministry vis-a-vis profit seekers, is not conducive to re-kindling animal spirits in the Indian economy.

It is this authors proposal (and has been for the last year at least), that the government take advantage of the situation in Europe to raise cheap money to recapitalize its banking system. This will allow the banks' to kitchen-sink its bad loans and start the next lending cycle. This is key if the quality of the reported GDP is to be improved. Currently the Real GDP growth is being driven by falling inflation (to almost deflationary levels) and increased government spending. Inflation control has been overdone to to extent that it is no longer possible for this author to differentiate whether it is genuine cost control or caused by a domestic debt deleveraging crisis. Thse unhealthily low inflation levels, further erode people's appetite to borrow money and create assets.

India's debt intensity is about 1.1x. Debt intensity = YY% in Nominal GDP/ YY% in Credit. This suggests that there is little danger of over heating in the economy if the government uses cheap global money for re-capitalizing banks and kick-starting lending.

While low coupon international paper issued by an Indian bank consortium or, even the Indian government, will be offset by unfavourable INR forward rates, I believe that the exposure can be dynamically managed, and left partly unhedged. Ultimately economics comes down to demographics. If India boasts some of the best demographics in the world, and a strong GDP growth, then the actual depreciation in the Indian Rupee will be less than that suggested by forward rates quoted by dealers (as those just reflect interest rate differentials anyway).

Thanks for sharing your knowledge to install & crack the Time Tables, but you need to update

ReplyDeleteit now. because there is a 2022 version available now.

eco-falling-ball-crack

This site have particular software articles which emits an impression of being a significant and significant for you individual, able software installation.This is the spot you can get helps for any software installation, usage and cracked.

ReplyDeleteeco falling ball crack

material batch uninstaller crack

mathtype crack

money pro crack

focusky premium crack

ReplyDeleteReally Appreciable Article, Honestly Said The Thing Actually I liked The most is the step-by-step explanation of everything needed to be known for a blogger or webmaster to comment, I am going show this to my other blogger friends too.

eco-falling-ball-crack

I am a professional web blogger so visit my website link is given below! To get more information

ReplyDeletesoftwaretube.net/

MathType Crack/